Budgeting is a crucial financial practice that helps individuals and families achieve their financial goals and maintain control over their expenses.

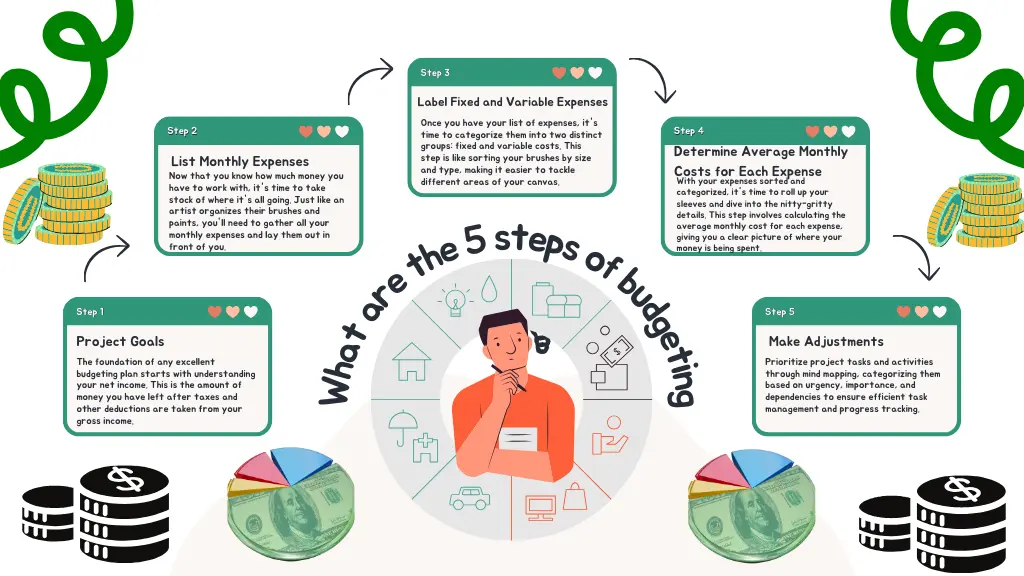

The five steps of budgeting are: calculate your net income, list monthly expenses, label fixed and variable expenses, determine average monthly costs for each expense, and make adjustments.

The first step is to calculate your net income, which is the amount of money you have left after taxes and other deductions are taken from your gross income.

The second step is to list all of your monthly expenses, including rent, utilities, groceries, and other recurring costs. The third step is to categorize your expenses as either fixed or variable.

In this article, we will explore each of these steps in detail, providing practical tips and strategies for implementing an effective budgeting plan.

By following these five steps, you can take control of your finances, reduce stress, and achieve your financial goals.

Step 1: Calculate Your Net Income

The foundation of any excellent budgeting plan starts with understanding your net income. This is the amount of money you have left after taxes and other deductions are taken from your gross income.

It’s like the palette of colors you’ll be working with – the more vibrant and varied the hues, the richer your financial canvas will be.

To calculate your net income, simply take your total earnings (from your job, side hustles, or any other sources) and subtract the mandatory deductions like taxes, Social Security, and insurance premiums. This number will be your monthly net income, the lifeblood of your budgeting endeavor.

Why is Net Income so Important?

Your net income is the cornerstone of your budget because it determines how much you can realistically allocate to different expenses.

It’s like the canvas size – the larger it is, the more room you have to paint your financial masterpiece.

By understanding your net income, you can make informed decisions about where your money should go, ensuring that every dollar is accounted for and working towards your financial goals.

Step 2: List Monthly Expenses

Now that you know how much money you have to work with, it’s time to take stock of where it’s all going.

Just like an artist organizes their brushes and paints, you’ll need to gather all your monthly expenses and lay them out in front of you.

Start by listing out every recurring expense you have, from rent or mortgage payments to utility bills, groceries, transportation costs, and any other regular expenditures.

Don’t forget to include those pesky subscriptions and memberships that often fly under the radar.

Why is Listing Expenses Important?

Listing your expenses is like sketching out the details of your financial painting. It allows you to see the bigger picture and identify areas where you might be overspending or where adjustments need to be made.

By having a comprehensive list of your expenses, you can prioritize and allocate your resources more effectively, ensuring that your basic needs are met while still leaving room for savings and discretionary spending.

Step 3: Label Fixed and Variable Expenses

Once you have your list of expenses, it’s time to categorize them into two distinct groups: fixed and variable costs. This step is like sorting your brushes by size and type, making it easier to tackle different areas of your canvas.

Fixed Expenses are those that remain relatively constant from month to month, such as rent, car payments, or insurance premiums.

These are the essential elements of your financial painting, the foundations upon which everything else is built.

Variable Expenses, on the other hand, are the ones that fluctuate, like groceries, entertainment, and utilities. These are the details and flourishes that add depth and character to your masterpiece.

Why is Categorizing Expenses Important?

By separating your fixed and variable expenses, you can better understand where your money is going and how much flexibility you have in your budget.

Fixed costs are typically non-negotiable, while variable expenses offer more room for adjustment and creativity.

This knowledge allows you to make informed decisions about where to cut back or where to splurge, ensuring that your financial canvas is balanced and tailored to your unique needs and goals.

Step 4: Determine Average Monthly Costs for Each Expense

With your expenses sorted and categorized, it’s time to roll up your sleeves and dive into the nitty-gritty details.

This step involves calculating the average monthly cost for each expense, giving you a clear picture of where your money is being spent.

For fixed expenses, this process is relatively straightforward – simply take the annual or recurring cost and divide it by the appropriate number of months.

For variable expenses, however, you’ll need to review your past spending habits and calculate an average based on historical data.

Why is Calculating Average Costs Important?

By understanding the average monthly cost of each expense, you can allocate your resources more accurately and identify areas where you might be overspending.

It’s like mixing the perfect shade of color – too much of one pigment, and the hue becomes muddled; too little, and the vibrancy is lost.

With accurate cost averages, you can fine-tune your budget and ensure that every dollar is being used effectively.

Step 5: Make Adjustments

Now comes the fun part – putting the finishing touches on your financial masterpiece! With your expenses categorized and average costs calculated, it’s time to make adjustments and ensure that your budget aligns with your goals and priorities.

Take a step back and examine your canvas. Are there areas where you can trim expenses without sacrificing quality of life?

Are there goals or dreams that require a greater allocation of resources? This is where you get to play with the composition, experimenting with different brushstrokes and color combinations until you find the perfect balance.

Why are Adjustments Important?

Adjustments are crucial because they allow you to tailor your budget to your unique circumstances and aspirations.

Life is ever-changing, and your financial plan should reflect that. By making adjustments, you ensure that your budget remains a living, breathing work of art, evolving as your needs and priorities shift.

Nest Step for you: What Is The Last Step In Planning Your Budget?

Tips for Successful Budgeting

Now that you’ve mastered the five steps of budgeting let’s explore some tips and tricks to help you create a true masterpiece:

- Involve the Whole Family: Budgeting is more effective when everyone is on board, just like a collaborative art project. Involve your family members in the process, encourage open communication, and make sure everyone understands the financial goals and priorities.

- Automate Savings and Bill Payments: Take the guesswork out of budgeting by setting up automatic transfers to your savings account and scheduling bill payments. This ensures that your financial obligations are met without any unnecessary stress or oversight.

- Track Your Progress: Regularly review your budget and track your progress towards your goals. This will help you identify areas for improvement and celebrate your successes along the way.

- Be Flexible: Remember, budgeting is an art, not a science. Don’t be afraid to make adjustments and pivot when necessary. Life is full of unexpected surprises, and your budget should be able to adapt accordingly.

- Celebrate Small Wins: Budgeting can be challenging, but it’s important to celebrate the small victories along the way. Whether it’s paying off a credit card or reaching a savings milestone, take a moment to appreciate your progress and reward yourself (within reason, of course!).

Budgeting: The Art of Financial Mastery

Budgeting is more than just crunching numbers and allocating funds – it’s a creative process, a dance between financial responsibility and personal expression.

By following these five steps and embracing the tips for success, you’ll be well on your way to creating a financial masterpiece that genuinely reflects your values, goals, and aspirations.

Remember, budgeting is an ongoing journey, and like any great work of art, it requires patience, dedication, and a willingness to adapt and evolve. But with each brushstroke, each careful calculation, you’re painting a brighter, more vibrant future for yourself and those you love.

So, pick up your palette, grab your brushes, and start creating your financial masterpiece today!

Conclusion

Budgeting is a crucial aspect of financial well-being, and by following the five essential steps outlined in this article, you’ll be well on your way to mastering the art of money management.

From calculating your net income to listing and categorizing your expenses, determining average costs, and making adjustments, each step builds upon the previous one, creating a comprehensive and personalized financial plan.

Remember, budgeting is not a one-time event but rather an ongoing process that requires regular review and adjustment.

As your circumstances change, your budget should adapt accordingly, ensuring that your financial goals and priorities remain aligned.

By embracing the tips for successful budgeting, such as involving your family, automating savings and bill payments, tracking your progress, and celebrating small wins, you’ll not only enhance the effectiveness of your budget but also make the process more enjoyable and rewarding.

Ultimately, budgeting is an art form, a delicate balance between financial responsibility and personal expression. Just as an artist carefully selects their colors and brushstrokes, you, too, have the power to shape your financial canvas, creating a masterpiece that reflects your unique values.

1 thought on “What are the 5 steps of budgeting? Unlocking Financial Freedom”